Why Do Your Business Needs Technology?

- To combat uncertain scenarios.

- Competing with rival firms in industry.

- To stay ahead of the competition.

- For retention of existing and acquisition of new clients.

Let us know how Mutual Fund Software for IFA facilitates advisors in acquiring more clients

- Dedicated planning

Advisors through the help of financial platform can develop suitable financial planning as per the risk appetite of the investors which helps in delivering desired rate of return to clients. The planning developed through the assistance of the technology gives the favorable results to the clients and the advisors as well. After having overall analysis of the investors an advisor can proceed for investing the funds of the clients. Ratios determined in the plan represent the financial health status of the investors along with the potential to bear risk in the market.

- Constant Tracker

Not only the planning facility is available but the advisors can also track the portfolio movements and the same can be shared with the clients as to retain their faith. Constant eye on funds provides surety of safe returns and reduces the chances of loss which attracts the investors. The advisors operating business with Mutual Fund Software are contributing to their best in the industry and achieving growth.

- Multiple Services

Having the power to deliver vivid services to the investors from one source gives you edge over the rivals and helps in attaining more client base because the investors shows interest in the advisors capable of providing multiple services which serve convenience to the investors. The advisors can give services of sending reports, notifications, greeting, investments, redemption and much more.

- Future Opportunity

Advisors can identify the future opportunity which helps them in gaining more number of investors. The amount to be received from clients assists advisors in retaining current investors and helps in informing investors before the due date. The relationship among the advisors and the investors improves with the transactions.

- Advance Features

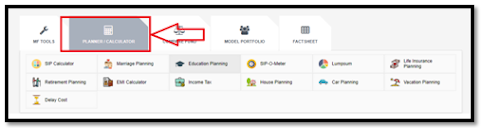

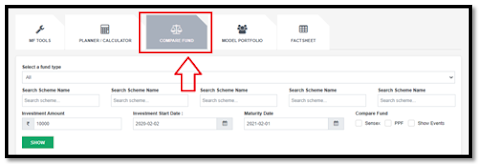

Clients shows their interest in advance facilities and features that doesn’t require efforts and time but gives the desired results and the Mutual Fund Software for Distributors does the same for the investors which helps advisors in securing more number of clients. Also the advance features reduces the task of the advisors and helps in improving the productivity of the entire firm.

Takeaway

The advisors can enhance the business performance through the trending technology and can deliver services to multiple clients at a time. Also the revenue of the business increases within very short span which improves the functioning of the firm.

For more information, visit @-https://www.redvisiontech.com/