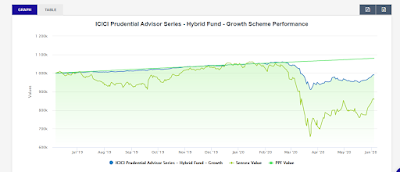

The research performed by the software is represented in summarized graphical manner to easily convince the investors for investment. The Mutual fund software for distributors accurately measures the probability for growth of schemes in future. For more information, visit @- https://www.redvisiontech.com/

At REDVision Technologies, We combine our Technical & Financial Domain Expertise to create world-class one-stop solutions for Financial Advisors like Mutual Funds software, Mutual Funds software for IFA, Mutual Funds software for Distributor, Wealth Management software, Financial Planning Generator, Financial Websites, Financial Tickers in India.

Thursday 30 July 2020

How Mutual fund software in India is facilitating advisors in overcoming challenges?

In the prior times the management of client was a complex task for advisors and delivering constant updates about the portfolio was not easy after the arrival of Mutual fund software in India the operations of business and providing services to client became easy for the advisors. For more information, visit @- https://www.redvisiontech.com/

Wednesday 29 July 2020

What is Research Desk?

The Research desk module of this mutual fund software is a tool that helps to promote sales for the advisors in different schemes based on showing performance reports of SIP, STP and SWP. The trends and growth reports prove reliable for investors before making decision of investment. The inclusion of various calculators helps to figure out the estimated profit on investment. You can also provide performance history of specific scheme to compare with others to suggest the best out of various schemes.

Why as an advisor Research Desk is foremost for you?

Research desk assist you in generating past performance of the schemes based on which you can recommend and encourage your client to initiate new investment in scheme showing high returns. It proves as reliable source for your investor and increases the chances of his consent towards investment that ultimately improves your business operations. Also the tool provides various calculators to estimate the future returns over the investment made in different segments like marriage, education planning, SIP’s and many more.

What problems usually advisors face without Research Desk?

· Tracking past performance of SIP, STP, SWP and dividend history will be typical and pursuing in-depth research on the schemes will be difficult.

· Advisors find it hard to convince the client for additional investment due to lack of research report and performance history.

· Showing a detailed comparison between different schemes is not possible.

· Advisors will be unable to identify future returns through different calculators that are only available in the tool.

· Without research tool generating model portfolio and factsheets of the scheme is not possible.

How Research desk is a solution for different problems of advisors?

· It helps advisors to make selection of growing schemes to suggest client for investing funds.

· The top performer schemes can be constantly monitored and track record can be shown to investors for reliability.

· Different calculators for SIP and other goals assist in identifying estimated future returns which attracts the customer for investment.

· Based on dividend history and comparing different funds recommending a particular scheme becomes easy for the advisors.

· Advisor can easily make understand to client about a plan through graphical representation showing trend for particular period rather than textual report.

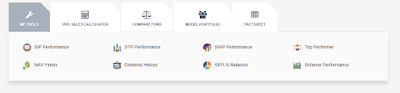

What all tools and facilities are available for advisors in Research Desk?

1 Mutual Fund Tools:

It includes various tools like SIP, STP, and SWP performance tracker that helps advisors to tracks the history of various schemes to figure out the best one which is suitable for investment by client. The tool also facilitates to represent the report in graphical and chart based manner to make the representation easy and unique.

2 Pre sales Calculator:

While suggesting a plan or scheme to client an advisor can use all such calculators to estimate the future returns that induces an investor for investment. It helps as promotional tool for advisors that motivates a client to buy the scheme for enhancing the image of portfolio.

3 Comparing Funds:

To provide best suggestion to client for investment comparing different plans is best way to get the trust of client and advisors can compare 5 different schemes at single time to select the fruitful scheme generating optimum returns.

4 Model Portfolio:

This tool allows setting percentage of assets to be allocated within total portfolio of client to derive the maximum returns from investment based on which personalized investment plan can be developed.

5 Fact sheet:

The fact sheet helps to identify the relevant information of schemes before making investment like corpus, NAV and scheme category.

It can also be used to track the performance of the schemes. For more information, visit @- https://www.redvisiontech.com/

Tuesday 28 July 2020

Why Mutual fund software for distributors continuously monitors portfolio?

The constant monitoring of portfolio is performed in order to ensure that investment is growing and no loss should be suffered to investor’s funds. The Mutual fund software for distributors never let the investment to generate negative returns. For more information, visit @- https://www.redvisiontech.com/

How Mutual fund software for IFA measures future returns?

The financial calculators assist in estimating future returns on the present value of investment which also helps advisors in attracting investors for investment. The Mutual fund software for IFA is consolidated with various features which improves business of advisors. For more information, visit @- https://www.redvisiontech.com/

Why Mutual fund software is among foremost required tools for advisors?

The advisors can operate business smoothly and effectively when they possess a tool that performs function on their behalf which only Mutual fund software can perform. It allows advisors to simply manage the back office operations without complexities and worries. For more information, visit @- https://www.redvisiontech.com/

Monday 27 July 2020

Why Mutual fund software for distributors manages all assets of investors?

In order to perform efficient wealth management the Mutual fund software for distributors allows the facility to manage data of different assets and also these assets helps advisor in mapping the funds for investors towards his goals. For more information, visit @- https://www.redvisiontech.com/

How Mutual fund software for IFA plans investment strategy for investors?

The planning is done as per the goals of the clients that help to form relevant strategy to achieve within stipulated time and this is done with the help of Mutual fund software for IFA to boost the growth of funds and keep tracking the directions of movements. For more information, visit @- https://www.redvisiontech.com/

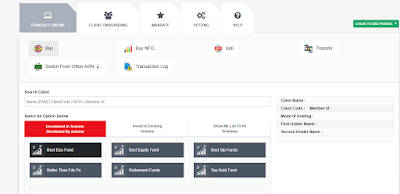

What is Invest Online in Wealth Elite?

Invest Online is a feature that facilitates advisors to pursue transactions of buy, sell and transfer for investors registered with BSE/NSE portal. It helps in performing instant transaction irrespective of location barrier after login any device. As an advisor you also get facility whether to allow your client to perform buy and sell or not in case investor is beginner in the mutual fund market.

Why Invest Online is important for advisors?

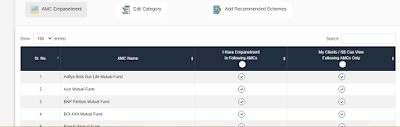

Invest Online module has significant role in operations of advisors as it saves the time of advisors by allowing transactions through digital platform without interruption. Also, in case of new client the on boarding formalities can easily be performed through the portal after submitting the relevant fields in the registration form which is convenient to understand in comparison of BSE/NSE portal. The Mutual fund software is embedded with a facility to categorize the top performing schemes to recommend the investors for investment and also you can get switch the funds of your client from other advisor’s ARN to your own ARN.

What problem did occur without Invest Online feature?

· Issues in performing instant transaction of buying and selling.

· Delaying in entering or exiting from schemes may convert the opportunity of gain into actual loss.

· Manually registration of client under BSE/NSE is a complex and time consuming process.

· Due to lack of online platform for investment the process of transaction becomes costly.

· Advisors earning and commissions get impacted due to less number of transactions.

How Invest Online is beneficial for advisors and helps to solve issues?

· The portal is user friendly and convenient to perform transaction.

· Client on boarding process is not typical in comparison of BSE/NSE platform.

· Transaction log can be access to analyze the report of investment.

· Mandate section ensures regular investment of funds in SIP without interruption.

· Advisors can shortlist popular schemes for recommendation to clients.

What are the sections available in Invest Online?

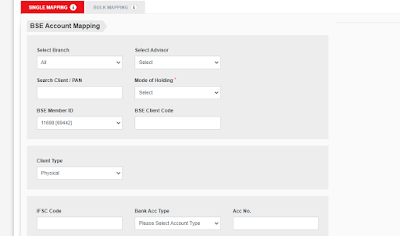

1 Transact Online:

The advisors get facility to pursue the transactions of buy, sell and transfer and also in case if client has made any previous investment with other advisor you can switch the particular funds under your ARN through the consent of the client. You can even check history of the previous transactions performed for analysis of portfolio.

2 Client On boarding:

This process is completed before making investment which requires registration of the investors under BSE portal. The platform also enables registration of new investors which is user friendly and quick verification is done for initiating instant investment. You can authorize customer to transact or deny and likewise the permission to redeem the funds or not is also under the control of advisor.

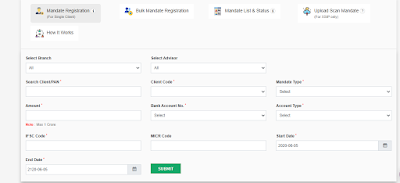

3 Mandate:

Mandate section is used for investment in SIP’s under which account of investors is opened for depositing funds that is used for accomplishing installments of SIP. This ensures that no installment should be jumped or delayed from due date. The amount is automatically deducted on the due date.

4 Settings and Help:

The particular section helps advisors to sort and categorize the priority schemes showing high trends and productive dividend history. The advisor use this facility to recommend schemes to investors for investment that yields high return on made investment.

The advisor can use help section whenever finding any trouble in transactions or business related queries. For more information, visit @- https://www.redvisiontech.com/

Subscribe to:

Posts (Atom)