Invest Online is a feature that facilitates advisors to pursue transactions of buy, sell and transfer for investors registered with BSE/NSE portal. It helps in performing instant transaction irrespective of location barrier after login any device. As an advisor you also get facility whether to allow your client to perform buy and sell or not in case investor is beginner in the mutual fund market.

Why Invest Online is important for advisors?

Invest Online module has significant role in operations of advisors as it saves the time of advisors by allowing transactions through digital platform without interruption. Also, in case of new client the on boarding formalities can easily be performed through the portal after submitting the relevant fields in the registration form which is convenient to understand in comparison of BSE/NSE portal. The Mutual fund software is embedded with a facility to categorize the top performing schemes to recommend the investors for investment and also you can get switch the funds of your client from other advisor’s ARN to your own ARN.

What problem did occur without Invest Online feature?

· Issues in performing instant transaction of buying and selling.

· Delaying in entering or exiting from schemes may convert the opportunity of gain into actual loss.

· Manually registration of client under BSE/NSE is a complex and time consuming process.

· Due to lack of online platform for investment the process of transaction becomes costly.

· Advisors earning and commissions get impacted due to less number of transactions.

How Invest Online is beneficial for advisors and helps to solve issues?

· The portal is user friendly and convenient to perform transaction.

· Client on boarding process is not typical in comparison of BSE/NSE platform.

· Transaction log can be access to analyze the report of investment.

· Mandate section ensures regular investment of funds in SIP without interruption.

· Advisors can shortlist popular schemes for recommendation to clients.

What are the sections available in Invest Online?

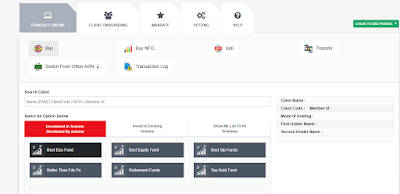

1 Transact Online:

The advisors get facility to pursue the transactions of buy, sell and transfer and also in case if client has made any previous investment with other advisor you can switch the particular funds under your ARN through the consent of the client. You can even check history of the previous transactions performed for analysis of portfolio.

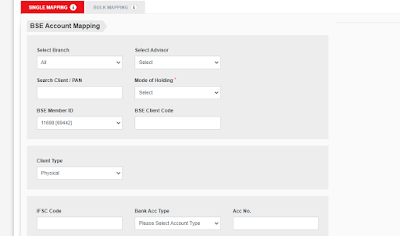

2 Client On boarding:

This process is completed before making investment which requires registration of the investors under BSE portal. The platform also enables registration of new investors which is user friendly and quick verification is done for initiating instant investment. You can authorize customer to transact or deny and likewise the permission to redeem the funds or not is also under the control of advisor.

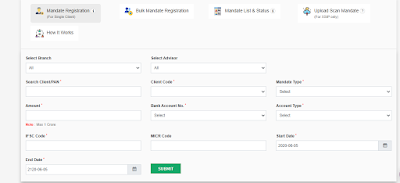

3 Mandate:

Mandate section is used for investment in SIP’s under which account of investors is opened for depositing funds that is used for accomplishing installments of SIP. This ensures that no installment should be jumped or delayed from due date. The amount is automatically deducted on the due date.

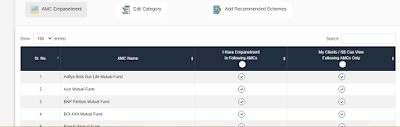

4 Settings and Help:

The particular section helps advisors to sort and categorize the priority schemes showing high trends and productive dividend history. The advisor use this facility to recommend schemes to investors for investment that yields high return on made investment.

The advisor can use help section whenever finding any trouble in transactions or business related queries. For more information, visit @- https://www.redvisiontech.com/

No comments:

Post a Comment